As referenced amid a bunch of stats within the preamble to RCR’s new editorial report on non-public 5G in Business 4.0 (see picture under), market analysis agency SNS Telecom & IT, primarily based out of Dubai, has mentioned the non-public 5G market is likely one of the “few vivid spots within the gloomy telecoms trade”, and recommended complete spending on non-public 4G (LTE) and 5G networks will $6 billion by the tip of 2027. Which is a marked slow-down, it may be famous, on its earlier forecast, which mentioned the market can be value $6.4 billion by 2026, primarily based on an 18 p.c compound yearly leap (CAGR) over the interval. So development is possibly slowing, versus previous forecasts at the very least.

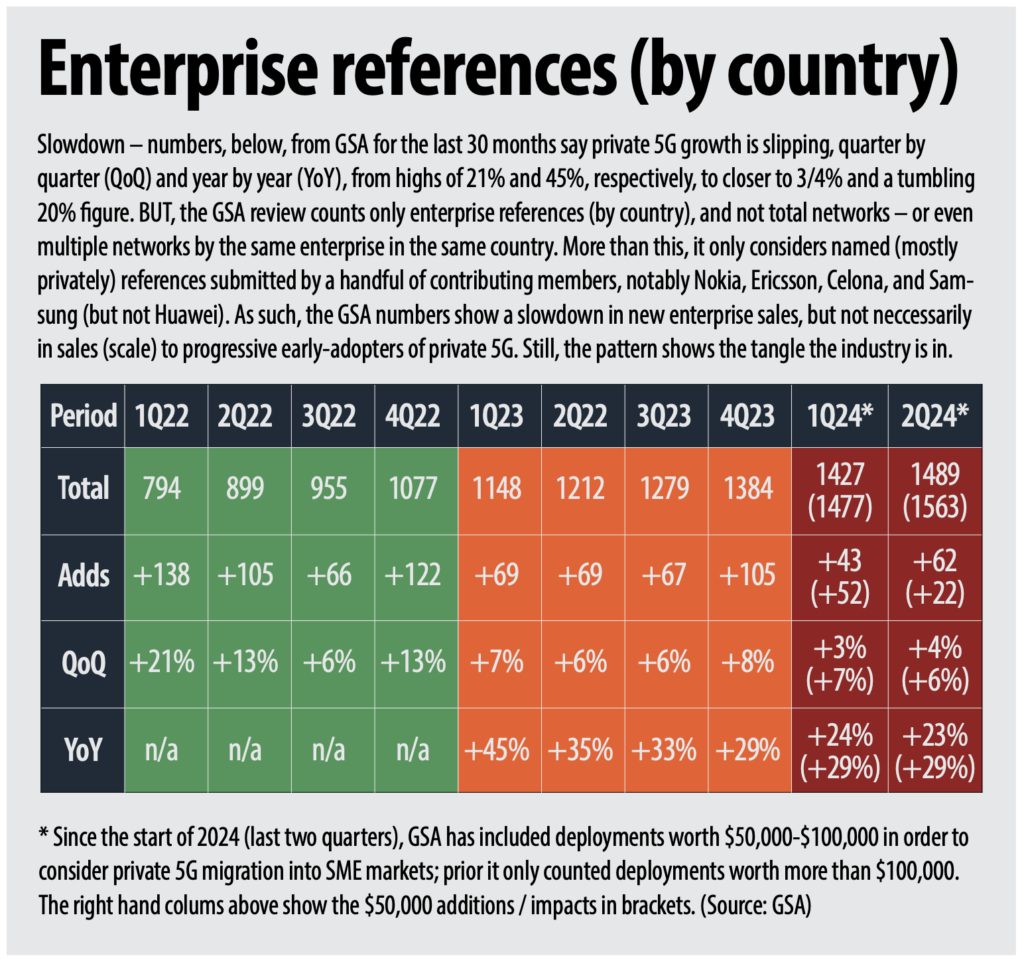

That is additionally what the newest GSA quarterlies counsel (as additionally referenced by RCR within the new report, in addition to the intro to the newest Industrial 5G Discussion board; out there on-demand): gross sales have slipped quarter-on-quarter and year-on-year from 21 p.c and 45 p.c in the beginning of 2022 and 2023, respectively, to simply 4 p.c and 20 p.c in the beginning of 2024 (see under). As RCR informed Industrial 5G Discussion board: “[This] could be defined away as a result of GSA counts enterprise references (by nation) and never complete networks – which implies present deployments could also be going nuts, multiplying upwards and outwards. Nevertheless it additionally says new clients (‘logos’) are more durable to seek out.”

Which implies – most likely; possibly, finally – the market is entering into the true enterprise of long-tail development. “Which is true, and proper the place it ought to be,” mentioned RCR at Industrial 5G Discussion board. However SNS Telecom & IT, which claims (like RCR, because it goes) to have counted the market since 2016 (since “nicely earlier than it garnered mainstream consideration”), says it has a database of over 7,300 non-public 4G/5G engagements in 130 international locations, as of the tip of 2024.

These are listed, named and nameless, within the eighth version of its private-networks report, out there right here. Its revised forecast places the CAGR-rate at 20 p.c within the interval to 2027.

What else does it provide you with? Effectively, near 60 p.c of its $6 billion guesstimate (about $3.5 billion) will go on ‘standalone’ non-public 5G networks – which implies, within the context, ultimately, each on-prem all-edge 5G installations, and in addition 5G SA expertise. “[These] will develop into the predominant wi-fi communications medium to assist the continued Business 4.0 revolution for the digitization and automation of producing and course of industries,” it says. By 2030, non-public 4G/5G networks might account for as a lot as a fifth of all cell community infrastructure spending, it suggests.

“Unprecedented development is prone to rework non-public 4G/5G… into an virtually parallel tools ecosystem to public [4G/5G]… by way of market dimension by the late 2020s.” The references to “standalone non-public 5G” are a bit of confused, maybe. It writes: “5G core infrastructure for standalone 5G connectivity providers has been deployed by lower than a tenth of the world’s roughly 800 public cell operators… [It] is experiencing far better success within the smaller however burgeoning non-public 5G section the place efficiency and effectivity benefits… are extra simply consumable within the brief time period.”

It makes comparability within the above quote with “benefits” of “non-standalone 5G networks” – which refers on to the in-between NSA-version of 5G. The purpose, to debate the confusion, is just that edge-based SA networks are the large focus. It references, fairly randomly, productiveness and effectivity positive aspects for “manufacturing, high quality management, and intralogistics processes within the vary of 20-to-90 p.c, price financial savings as excessive as 40 p.c, and an uplift of as much as 80 p.c in employee security and accident discount”. There’s a entire bunch in there that anybody studying RCR will know very nicely, however its lists and recommendations are helpful.

It names strikes by regulators, say, to make devoted spectrum out there to enterprises to deploy non-public 4G/5G networks in: Australia, Bahrain, Brazil, Canada, Finland, France, Germany, Hong Kong, Eire, Japan, the Netherlands, Norway, Poland, Spain, Slovenia, South Korea, Sweden, Switzerland, Taiwan, the UK, the US. It says large operators (with “in depth spectrum”) retain a “vital presence”, basically as consultancy and integrator corporations, with out rating or naming them. In any other case, new lessons of 4G/5G suppliers embody: “Boldyn, American Tower, Boingo Wi-fi, Crown Fort, Freshwave, and Digita”

Key specialist integrators are named as: NTT, Kyndryl, Accenture, Capgemini, EY, Deloitte, KPMG. The massive hyperscalers – AWS, Google, Microsoft – are all providing managed non-public 5G providers (“by leveraging their cloud and edge platforms”) – though it may be famous that Microsoft has shut down its Metaswitch experiment. Of the seller market, it says: “Though Nokia, Ericsson, Samsung, and Huawei proceed to steer the non-public mobile market by way of infrastructure gross sales, there’s a lot better vendor range than within the public cell community section.”

Once more, it suggests some seemingly protagonists, notably (so as): Celona, Baicells, Druid Software program, Fujitsu, NEC Company, JMA Wi-fi, Cisco Programs, Airspan Networks, Telrad Networks, and HPE/Athonet. Helpfully, it additionally takes the time to focus on numerous large-scale current non-public 5G deployments – protection of which could be discovered right here.