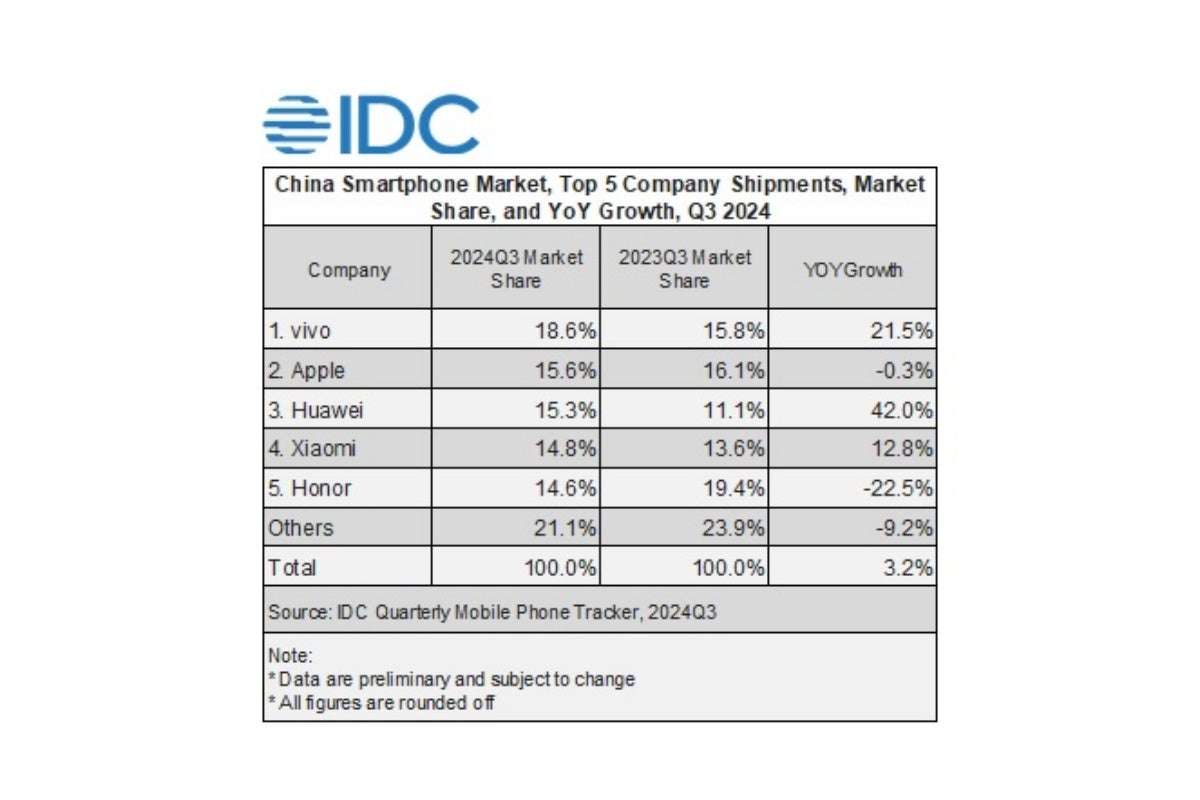

Like the worldwide cellular business as an entire, the world’s largest smartphone market continues to broaden at a comparatively gradual however decidedly regular tempo. Not like just about in every single place else, Samsung’s presence in China is just about insignificant, with Vivo as soon as once more beating everybody from Apple to Huawei, Xiaomi, and Honor for one more regional gross sales crown.

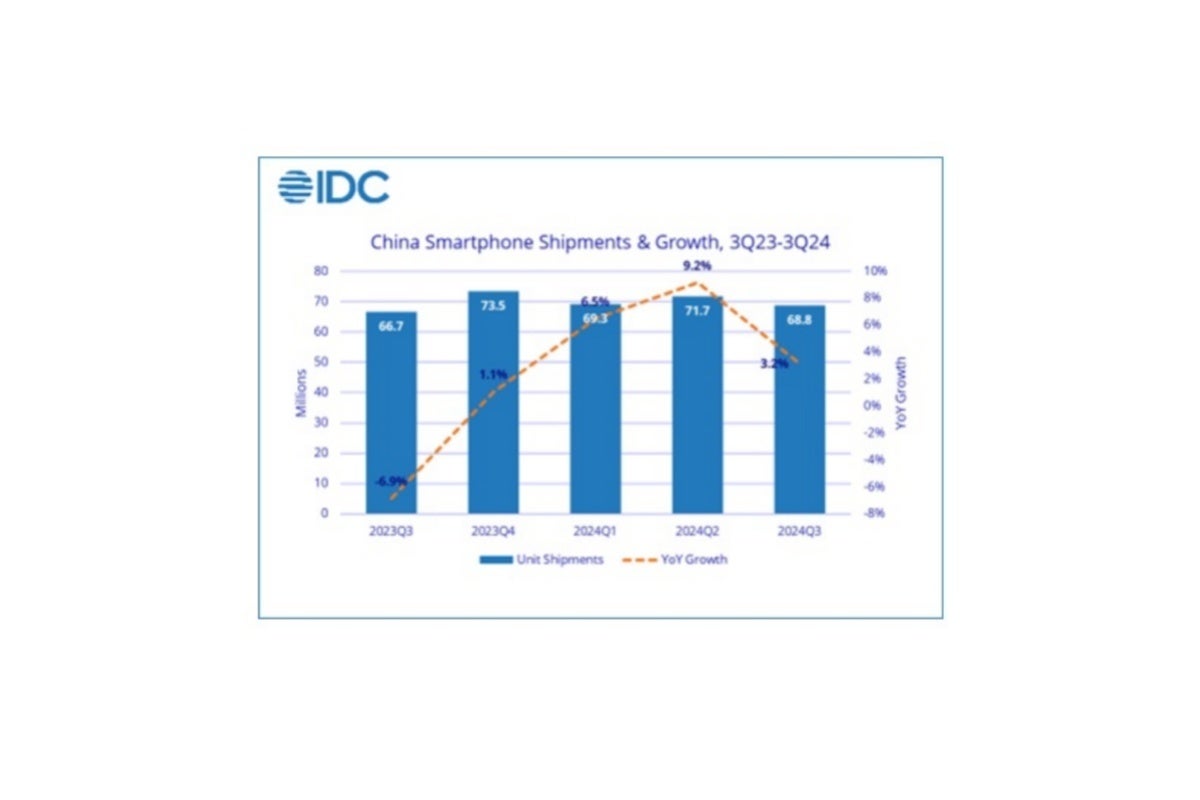

In complete,

the Worldwide Knowledge Company (IDC) estimates that 68.8 million smartphones have been shipped throughout this yr’s third quarter in China, representing a small however essential bump of three.2 % over final yr’s Q3 tally. That is the nation’s fourth consecutive quarterly progress, and regardless of

Apple‘s spot on the rostrum, the market’s progress continues to be largely pushed by native gamers.

A whole lot of progress for some manufacturers… and somewhat little bit of stagnation for others

Vivo, for one, managed to enhance its gross sales figures by a wholesome 21.5 % from Q3 2023, retaining a dominant place it

narrowly obtained in Q2 2024. Apparently, Huawei slipped from its silver medal placement throughout this yr’s April-June timeframe to the final spot on the rostrum now, nonetheless posting a large surge of 42 % in shipments in comparison with Q3 2023.

The Chinese language market chief has a reasonably wholesome benefit over 4 very shut rivals.

In the meantime, Apple was truly nowhere to be discovered amongst China’s prime 5 smartphone distributors in Q2 2024, so its leap to second place within the Q3 2024 chart would possibly really feel like a reasonably wonderful achievement. On the not so shiny facet of issues, the corporate’s Chinese language iPhone gross sales are down by 0.3 % in comparison with Q3 2023, which makes it fairly clear that the

iPhone 16 sequence is roughly as profitable because the

iPhone 15 household however not at all extra so.

For what it is value, the

impending Apple Intelligence launch and

iPhone 16 promotions which might be seemingly across the nook may assist the Cupertino-based tech big keep its place within the Chinese language prime three.

What’s additionally undoubtedly value highlighting in regards to the IDC’s newest report is the very small hole between Apple, Huawei, Xiaomi, and Honor’s regional gross sales numbers. Apple is barely 0.3 % forward of Huawei in market share proper now, whereas Xiaomi in some way managed to beat Honor 14.8 % to 14.6 % in Q3 2024 regardless of the latter model holding an enormous benefit of almost 6 % share a yr earlier than.

What’s on the horizon for Apple and its rivals?

That is clearly an extremely aggressive market that may proceed to yield some very evenly matched battles for the foreseeable future, and if Apple needs to maintain up with its Chinese language rivals, the

iPhone 17 lineup and particularly the

iPhone SE 4 might want to convey one thing new and progressive to the desk. Both that or an unbeatable worth equation.

China’s smartphone market has been rising for a number of quarters now and will proceed to take action for a number of extra.

In any other case, it would definitely be tough to fend off Huawei, which has basically come again from the brink of demise stronger and extra bold than ever earlier than with a powerful foldable portfolio that already contains (amongst others)

the world’s first tri-fold mannequin.

Xiaomi and Honor’s threats are to not be ignored both, with the previous firm seeking to “push boundaries” within the high-end section whereas sustaining its main budget-friendly focus and the latter model ruling the huge (albeit not-very-profitable) $100 to $200 value bracket.

Vivo and Honor, in fact, maintain a key native benefit over Apple and a world benefit over Samsung of their remarkably reasonably priced foldable high-enders, that are rising increasingly fashionable in China (in addition to throughout many main European markets).