This previous week feedback made by

T-Cellular CEO Mike Sievert

set off a panic amongst traders within the provider’s publicly listed shares. Really, Sievert made a remark about his expectations for the corporate’s fourth quarter that had been misinterpreted by an analyst who believed that the manager was delivering a warning to traders.

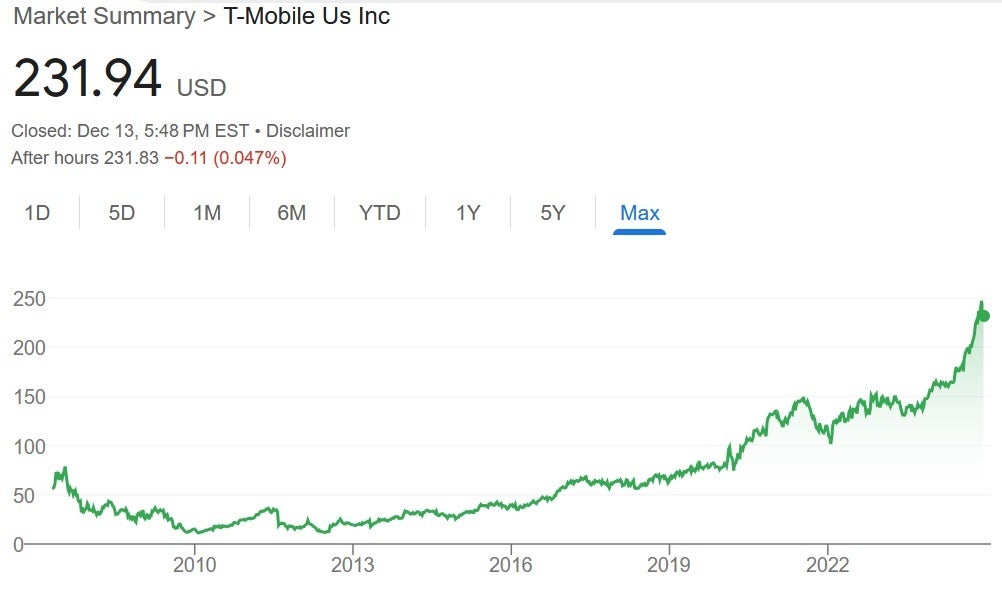

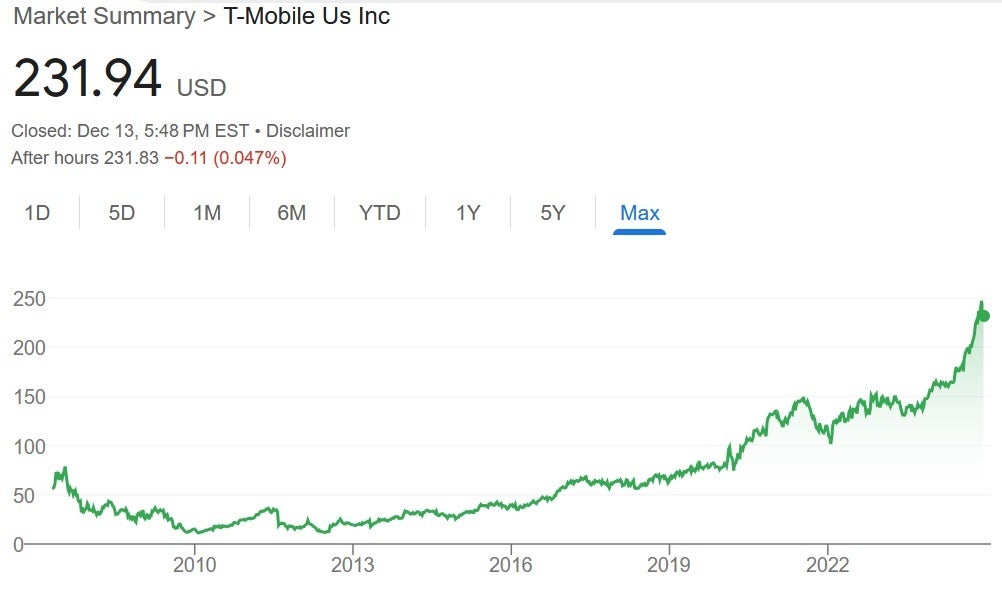

T-Cellular‘s traders took a heavy beating because the shares plunged $14.92 or 6.12% to shut at $228.86. That was a pointy drop from the just lately set 52-week excessive of $248.16.

Yesterday,

T-Cellular introduced

that it’ll spend billions of {dollars} to help the inventory. Beforehand, the corporate introduced that it might return as much as $50 billion to stockholders over the subsequent three years. This determine would not embody the $19 billion that the corporate final 12 months agreed to return to shareholders earlier than the top of this 12 months. This ploy of propping up an organization’s inventory by asserting that the corporate will return cash to stockholders just isn’t solely authorized however can be a typical observe on Wall Avenue.

Returning cash to stockholders may be finished by paying stockholders money or inventory dividends, or by implementing a inventory buyback. The latter entails an organization shopping for again a few of its personal inventory. The money and inventory dividends are just about self-explanatory because the stockholders are despatched a test for the quantity of the dividend or are despatched extra shares to cowl the quantity of the dividend.

T-Cellular’s shares have been in an uptrend for about a 12 months. | Picture credit-Google

With the inventory buyback, the corporate locations purchase orders by means of a dealer and pays the prevailing worth for the inventory on the time the buyback begins. This reduces the variety of shares excellent and in principle, raises the worth of the remaining shares. On Friday, T-Cellular stated that it might spend as a lot as $14 billion by the top of 2025 shopping for again its personal shares.

Earlier this month

AT&T stated that it might return over $40 billion to stockholders over the subsequent three years. The telecom firm stated that it might accomplish this aim by means of using dividends and share repurchases.

On Friday, T-Cellular shares closed the common buying and selling session at $231.94, a decline of $1.33 on the day. Nonetheless, that’s greater than $3 greater than the value that the inventory closed eventually Monday following Sievert’s feedback which had been made on the UBS World Media and Communications Convention.