These should be the latest ideas of Qualcomm bosses, after they discovered what’s coming from their associate, Arm Holding.

Arm, a UK-based firm (owned by Japan’s SoftBank), designs the CPU cores utilized in roughly 95% of the world’s smartphones. Along with its CPU know-how, Arm additionally develops the Mali line of graphics processing models (GPUs).

And what’s coming is that Arm Holdings has terminated a long-standing licensing settlement with Qualcomm, marking a significant escalation of their ongoing authorized battle over chip know-how.

Arm issued Qualcomm a 60-day discover to finish the architectural license, which permits the US agency to design its personal chips utilizing Arm’s mental property. This improvement threatens to disrupt the smartphone and pc markets, as each firms are influential gamers within the semiconductor business, reads a report by Bloomberg.

On the coronary heart of the conflict is Qualcomm’s 2021 buyout of Nuvia, a chip design startup that Arm says crosses the road of their licensing settlement. Qualcomm insists the unique settlement covers Nuvia’s actions, however Arm disagrees, accusing Qualcomm of breaching the phrases by incorporating Nuvia’s know-how into its merchandise with out renegotiating the contract.

A spokesperson from Qualcomm talked to the Samsung-oriented website SamMobile:

That is extra of the identical from ARM – extra unfounded threats designed to strongarm a longtime associate, intervene with our performance-leading CPUs, and enhance royalty charges whatever the broad rights below our structure license. With a trial quick approaching in December, Arm’s determined ploy seems to be an try and disrupt the authorized course of, and its declare for termination is totally baseless. We’re assured that Qualcomm’s rights below its settlement with Arm will likely be affirmed. Arm’s anticompetitive conduct won’t be tolerated.

They’re accusing Qualcomm of sneaking Nuvia’s tech into their merchandise with out bothering to renegotiate. If Arm pulls the plug on the license, Qualcomm may need to cease making the chips that earn an enormous chunk of their $39 billion income – or get hit with some severe authorized warmth.

The battle is about to be resolved in court docket, with each events headed for a trial in December. The authorized rigidity has already affected inventory costs, with Qualcomm shares dropping 5% and Arm’s declining 1.1% following the announcement.

So, Arm argues that the disputed designs had been created earlier than Qualcomm’s acquisition of Nuvia and must be destroyed until Qualcomm obtains new permissions.

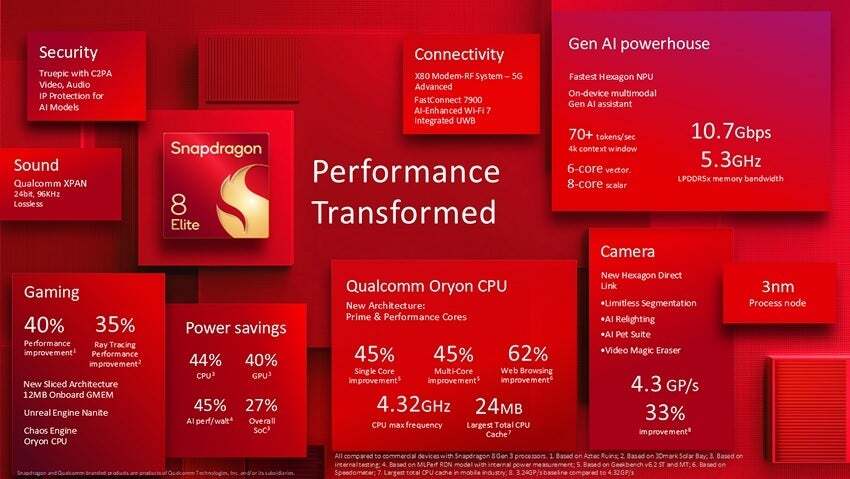

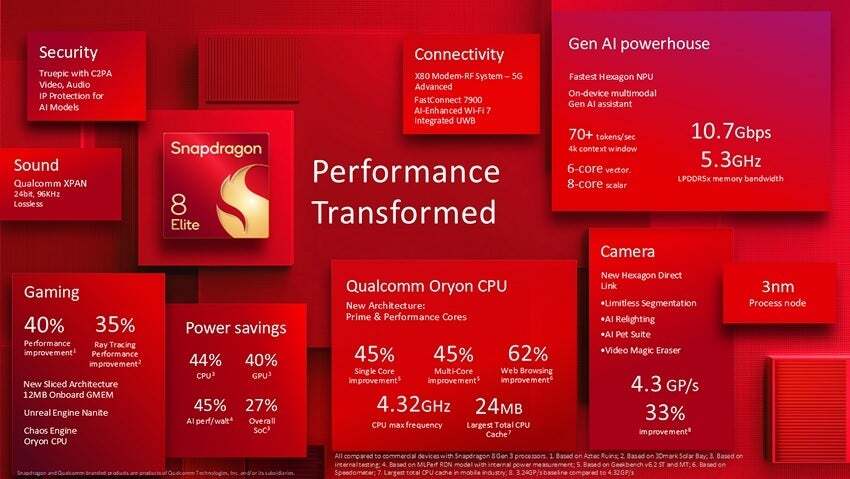

Infographic for the Snapdragon 8 Elite utility processor. | Picture credit-Qualcomm

Analysts consider Arm’s cancellation of the license could possibly be a tactical transfer to realize leverage earlier than the upcoming trial. Some count on the dispute will in the end be resolved by a renegotiated settlement, doubtlessly at the next price to Qualcomm for utilizing Arm’s structure.

Arm, which has more and more moved towards providing full chip designs below the management of CEO Rene Haas, goals to safe extra income from its technological contributions. This strategy locations Arm in direct competitors with Qualcomm, which, below CEO Cristiano Amon, has been shifting in the direction of growing its personal chip know-how.

Regardless of these strategic shifts, Qualcomm stays reliant on Arm’s instruction set for its chips, even because it seeks to scale back that dependency. Ought to the license termination proceed, Qualcomm should still be capable to use Arm’s normal designs however would face vital setbacks, together with delays and wasted improvement efforts.

The businesses’ diverging enterprise methods come after years of shut collaboration that helped drive the smartphone business ahead. Now, each want to broaden into new areas, together with AI and computing, which has led to heightened competitors between them. The result of this dispute may have long-term implications for his or her future cooperation and the broader tech business.