Apple Card handed its 5 12 months anniversary this 12 months, and I’ve lately been enthusiastic about whats subsequent for the bank card. With Apple Card not being tremendous worthwhile, mixed with the truth that Apple desires to develop its providers income amongst declining {hardware} gross sales, I feel it may make a variety of sense for Apple to begin providing a better finish bank card.

Apple Card right now

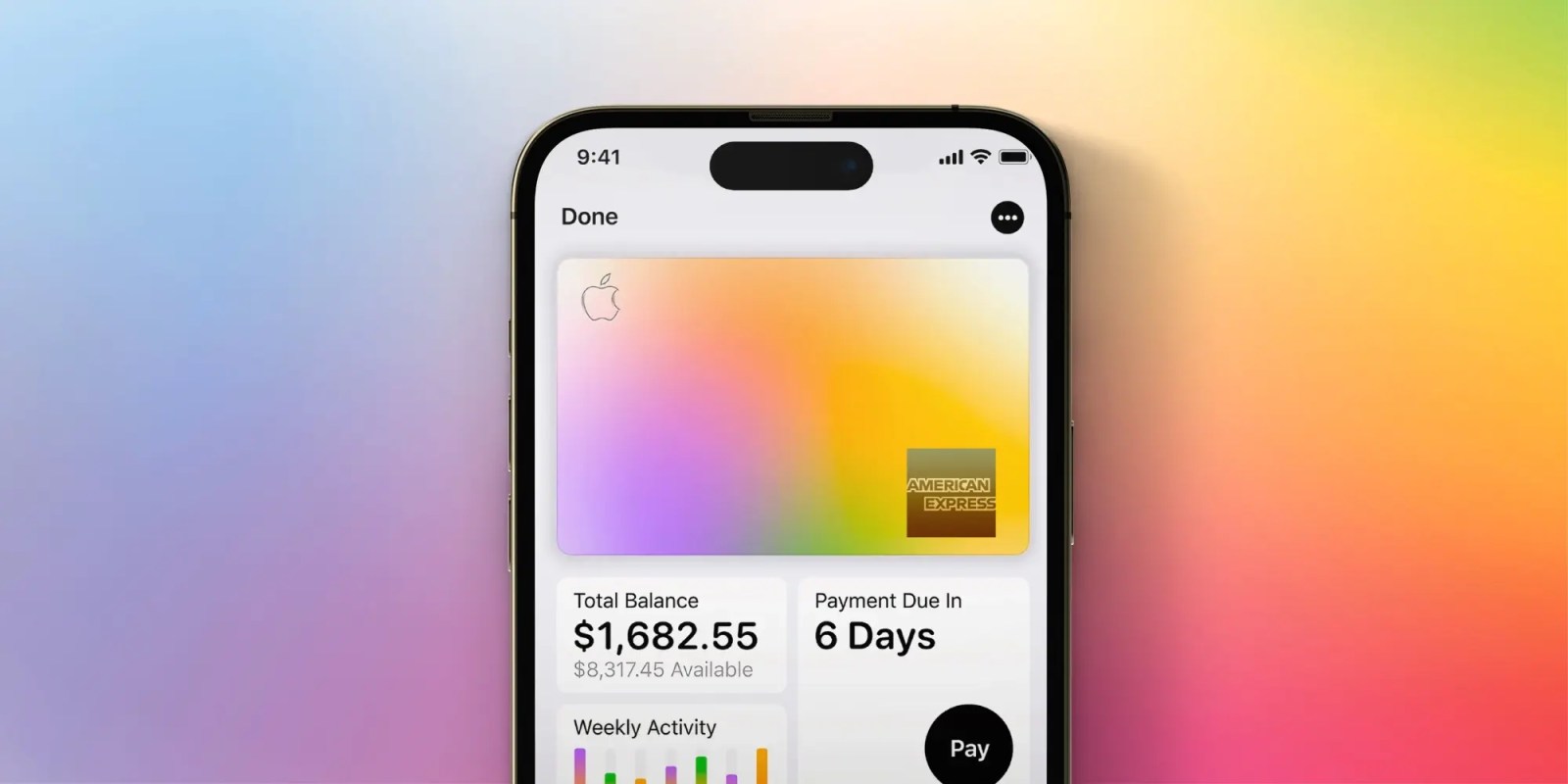

At the moment, Apple Card is a straightforward, no annual charge bank card centered on offering 2% money again everytime you use Apple Pay. It additionally has an elevated 3% class for Apple and different associate retailers, incentivizing customers to spend more cash at Apple. It’s not dangerous, but in addition it’s not a brilliant thrilling bank card.

Lately, they added two new companions that provide 3% money again: ChargePoint and Reserving.com. The latter is an attention-grabbing one, as a result of you may as well earn an extra 2% again within the type of Reserving.com journey credit.

Apple Card in its present kind has price Goldman Sachs, Apple’s banking associate – over a billion {dollars}. Goldman Sachs is ready to exit its Apple Card partnership within the subsequent 3-ish months due to that. With these two issues on the desk, I feel it is perhaps fairly attention-grabbing to see an annual charge model of the Apple Card, extra centered on journey.

The competitors

There are a selection of banks within the general-purpose journey bank card house, akin to Chase, American Specific, Citi, and Capital One. Once I say general-purpose, I simply imply that the playing cards aren’t in direct partnership with one airline or lodge. Nevertheless, most of those setups require a number of playing cards if you wish to maximize worth. I feel Apple may simplify issues, and make general-purpose journey bank cards extra interesting to a wider viewers.

For instance, a preferred setup is the Chase Trifecta, composed of the Chase Freedom Limitless, Chase Freedom Flex, and Chase Sapphire Most popular. The primary two playing cards aren’t any annual charge, and the third is $95, and the three playing cards all earn in the identical factors ecosystem, permitting you to pool all of them collectively, and switch them out to one in all Chase’s journey companions – akin to Southwest Airways, World of Hyatt, or one of many many others.

The Chase Freedom Limitless’s major goal is to earn 1.5x factors on all purchases, the Freedom Flex is available in with 5x factors on sure rotating classes (fuel stations, grocery shops, and many others), and the Sapphire Most popular is available in with 3x on eating, and 2x on journey. Sapphire Most popular additionally has a bunch of journey insurances, making it the go-to card for placing something journey associated on.

‘Apple Card Professional’ earnings

I feel Apple may make a extremely good single bank card centered on journey, though it wouldn’t be straightforward. Apple would wish to determine partnerships with a bunch of lodge and airways to make the Apple level ecosystem value utilizing, which banks like Wells Fargo and Capital One have struggled with. Neither of these banks have partnerships with home US airways.

With Apple’s journey bank card, I feel the construction of incomes 1x factors with the bodily card and 2x factors at Apple Pay ought to stick round. It’d permit the cardboard to nonetheless function a very good catch-all. They’ll additionally hold round 3x on Apple, though they need to drop the entire different partnerships. As an alternative, they need to deal with rewarding customers with 3x factors for any eating or journey, making customers extra prone to think about the Apple Card Professional as their major bank card.

The cardboard may most likely goal round a $299 annual charge, just like the Amex Gold card. Apple may assist customers justify the cardboard with two main perks: lounge entry, and unique occasions.

Journey advantages

Apple may set up a partnership with Precedence Move, and permit Apple Card “Professional” clients to entry 1600+ airport lounges worldwide. It’d be one of many extra reasonably priced bank cards to supply this profit, so it’d doubtless have a limitation on visits, maybe 12 a 12 months – which might nonetheless be greater than sufficient for most individuals. And the good factor is, if customers don’t take full benefit of these visits, Apple (and the issuing financial institution) will get to revenue from the annual charge paid.

Apple may additionally copy the American Specific strategy, and permit its clients to buy sure hard-to-get live performance tickets and such early – by way of the type of an unique presale. This could even be an enormous perk that may incentivize clients to pay the upper annual charge of an Apple Card Professional.

It’d even be fairly neat to see Apple work on a unified journey portal to seek for level redemptions throughout all of their various companions, just like level.me. One of many annoyances of transferring factors is that it’s a must to search every associate individually to search out the very best worth, and I feel Apple may make that course of simpler.

My favourite iPhone equipment on Amazon:

Comply with Michael: X/Twitter, Bluesky, Instagram

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.