However the story focuses on T-Cell‘s fastened wi-fi and fiber companies. The corporate has a lead in fastened wi-fi which sends 5G alerts to properties. The service lately hiked its forecast and now expects to have 12 million fastened wi-fi prospects by 2028 from the eight million anticipated subsequent 12 months. However T-Cell might need already reaped the rewards from choosing low-hanging fruit and is likely to be having issues discovering new prospects for the service. Throughout the second quarter of this 12 months, the corporate added 406,000 fastened wi-fi subscribers which was down 27% year-over-year.

S&P expects income from fiber to triple fastened wi-fi income by 2027

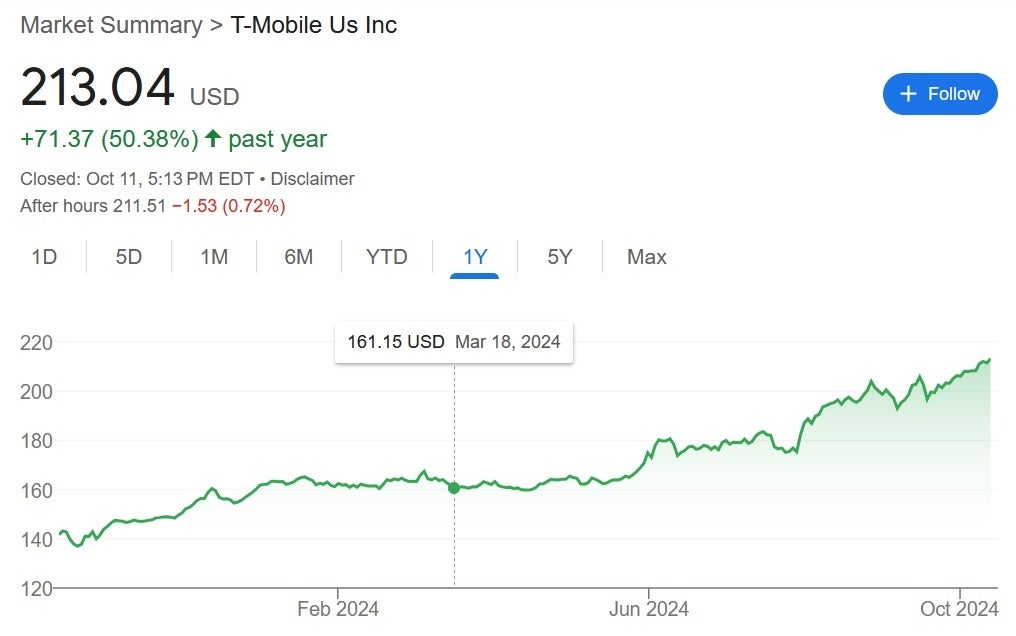

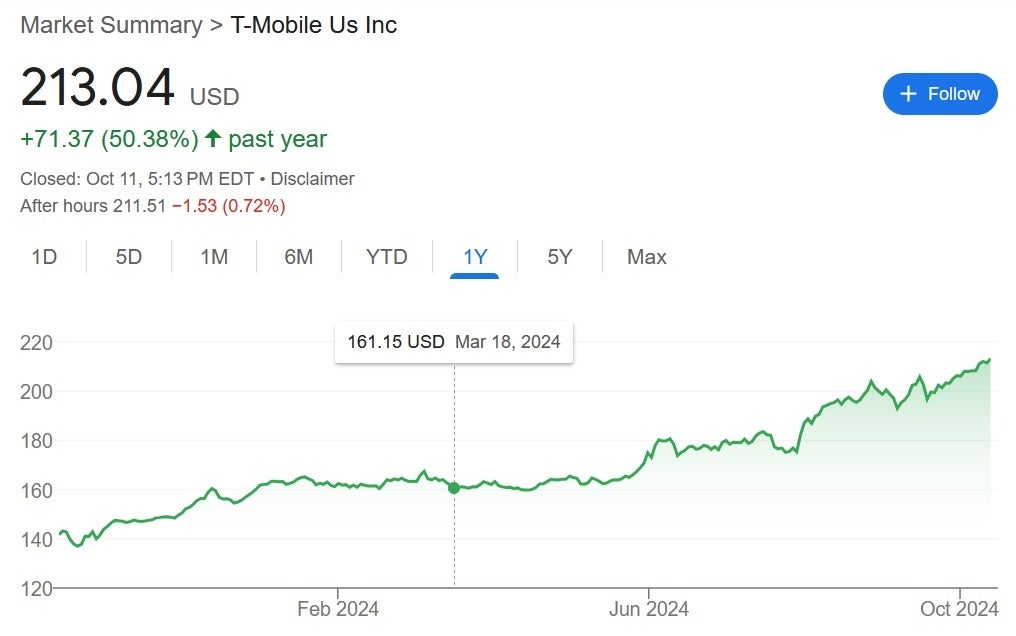

T-Cell shares are up 50% over the past 12 months. | Picture credit-Yahoo

“There’s nothing that beats fiber when it comes to the marginal price of carrying the following unit of site visitors. And on account of that, it is all the time going to be cheaper and higher efficiency than every other know-how on the market. And it’ll carry the lion’s share of workloads, and that is why we’re making the wager on that infrastructure funding.”-John Stankey, AT&T CEO

Why T-Cell buyers must be involved

T-Cell has promised to return $50 million to stockholders by means of dividends and buybacks. However the cash is likely to be put to higher use by buying corporations with fiber. Barron’s mentions Google Fiber, Lumen Applied sciences, and Windstream as three potential candidates for T-Cell to go after. Oppenheimer analyst Timothy Horan says that T-Cell has put apart $20 billion for potential mergers. Which may not look good for buyers who would like that the funds be distributed to them by means of dividends, or used to scale back the variety of shares excellent by saying a share buyback.

Barron’s additionally notes that whereas T-Cell‘s shares commerce at 23 instances earnings, each AT&T and Verizon commerce at lower than 10 instances earnings. On Wall Avenue, T-Cell‘s inventory has earned a premium maybe due to the repute it earned below John Legere because the quickest rising and most revolutionary of the main wi-fi suppliers.

Ought to buyers really feel that too and determine that T-Cell is now not value a premium P/E ratio, T-Cell may find yourself buying and selling nearer to the 10x earnings that AT&T and Verizon commerce at which might knock the inventory down sharply.